Try to reach an agreement with your lender before you decide whether to cancel your mortgage. Lenders want to avoid you defaulting, so they will try to negotiate a deal. You may find that they are willing to work with your situation to prevent you from affecting your credit score or harassing collection agencies.

If your child is in college, don't leave a mortgage open to you.

It is a large investment to purchase a home. To make sure you are not subject to a recourse mortgage, many states require that you apply for a nonrecourse mortgage. It is important to remember that defaulting on your mortgage can damage your credit score. By paying your bills promptly, you can minimize the damage. Jack Reed, real estate expert, believes that now is the best time to default in a mortgage. This is because so many people are falling behind with their payments.

Credit damage

Your credit can suffer if you walk away from your mortgage. If a borrower has a 780 credit score, they will see a 150-point decrease in their credit score. This can make it difficult for you to get a new job, or apartment. This can also lead to higher interest rates.

By being prepared, you can avoid any credit damage. The first thing you should do is think about whether you want a new home or if you'd like to rent an apartment. You may also be interested in shopping for a car. This should be done before your credit score drops. Also, make sure to set aside enough money to get through this transition.

Harassment by collection agents

You must be familiar with your rights as a debt collector if you want to get out of a mortgage. First, they are not allowed to contact you on your cell phone without your consent. You can record their calls if you are unable or unwilling to answer their calls. You can also save voicemail messages. Also, notify the collection agency about your intention to use these recordings in your lawsuit.

You also need to know that you have the right to report abusive collection practices directly to the Consumer Financial Protection Bureau, or the state attorney-general's office. In order to do this, you must provide details about the debt collector's communication methods, their response and whether or not they reached fair resolution. You should also keep a record of any correspondence you receive from the debt collector. To help you assess your case, you can seek out the advice of a consumer advocate.

FAQ

Is it possible fast to sell your house?

It may be possible to quickly sell your house if you are moving out of your current home in the next few months. There are some things to remember before you do this. First, you will need to find a buyer. Second, you will need to negotiate a deal. Second, prepare your property for sale. Third, advertise your property. Finally, you should accept any offers made to your property.

How can you tell if your house is worth selling?

Your home may not be priced correctly if your asking price is too low. If you have an asking price well below market value, then there may not be enough interest in your home. Get our free Home Value Report and learn more about the market.

Should I rent or own a condo?

Renting is a great option if you are only planning to live in your condo for a short time. Renting lets you save on maintenance fees as well as other monthly fees. A condo purchase gives you full ownership of the unit. The space is yours to use as you please.

How do I eliminate termites and other pests?

Your home will be destroyed by termites and other pests over time. They can cause serious destruction to wooden structures like decks and furniture. It is important to have your home inspected by a professional pest control firm to prevent this.

Can I get a second loan?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is typically used to consolidate existing debts or to fund home improvements.

What is a reverse loan?

Reverse mortgages allow you to borrow money without having to place any equity in your property. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types: government-insured and conventional. You must repay the amount borrowed and pay an origination fee for a conventional reverse loan. FHA insurance covers your repayments.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

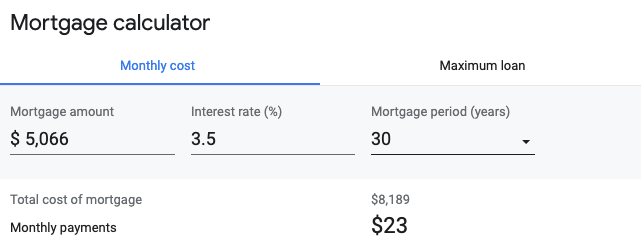

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

External Links

How To

How to Manage a Rental Property

Renting your home can be a great way to make extra money, but there's a lot to think about before you start. These tips will help you manage your rental property and show you the things to consider before renting your home.

If you're considering renting out your home, here's everything you need to know to start.

-

What is the first thing I should do? Before you decide if your house should be rented out, you need to examine your finances. You may not be financially able to rent out your house to someone else if you have credit card debts or mortgage payments. Your budget should be reviewed - you may not have enough money to cover your monthly expenses like rent, utilities, insurance, and so on. This might be a waste of money.

-

How much does it cost to rent my home? It is possible to charge a higher price for renting your house if you consider many factors. These include things like location, size, features, condition, and even the season. It's important to remember that prices vary depending on where you live, so don't expect to get the same rate everywhere. Rightmove has found that the average rent price for a London one-bedroom apartment is PS1,400 per mo. If you were to rent your entire house, this would mean that you would earn approximately PS2,800 per year. While this isn't bad, if only you wanted to rent out a small portion of your house, you could make much more.

-

Is it worth the risk? It's always risky to try something new. But if it gives you extra income, why not? Before you sign anything, though, make sure you understand exactly what you're getting yourself into. You will need to pay maintenance costs, make repairs, and maintain the home. Renting your house is not just about spending more time with your family. These are important issues to consider before you sign up.

-

Are there any benefits? So now that you know how much it costs to rent out your home and you're confident that it's worth it, you'll need to think about the advantages. You have many options to rent your house: you can pay off debt, invest in vacations, save for rainy days, or simply relax from the hustle and bustle of your daily life. It's more fun than working every day, regardless of what you choose. Renting could be a full-time career if you plan properly.

-

How do I find tenants? After you have made the decision to rent your property out, you need to market it properly. You can start by listing your property online on websites such as Rightmove and Zoopla. Once potential tenants reach out to you, schedule an interview. This will enable you to evaluate their suitability and verify that they are financially stable enough for you to rent your home.

-

What can I do to make sure my home is protected? If you fear that your home will be left empty, you need to ensure your home is protected against theft, damage, or fire. You will need insurance for your home. This can be done through your landlord directly or with an agent. Your landlord may require that you add them to your additional insured. This will cover any damage to your home while you are not there. If you are not registered with UK insurers or if your landlord lives abroad, however, this does not apply. In such cases, you will need to register for an international insurance company.

-

It's easy to feel that you don't have the time or money to look for tenants. This is especially true if you work from home. But it's crucial that you put your best foot forward when advertising your property. Make sure you have a professional looking website. Also, make sure to post your ads online. A complete application form will be required and references must be provided. Some people prefer to do everything themselves while others hire agents who will take care of all the details. You'll need to be ready to answer questions during interviews.

-

What should I do after I have found my tenant? If you have a contract in place, you must inform your tenant of any changes. You can negotiate details such as the deposit and length of stay. Keep in mind that you will still be responsible for paying utilities and other costs once your tenancy ends.

-

How do I collect my rent? When the time comes for you to collect the rent you need to make sure that your tenant has been paying their rent. If they haven't, remind them. You can subtract any outstanding rent payments before sending them a final check. You can always call the police to help you locate your tenant if you have difficulty getting in touch with them. If there is a breach of contract they won't usually evict the tenant, but they can issue an arrest warrant.

-

How do I avoid problems? Although renting your home is a lucrative venture, it is also important to be safe. Make sure you have carbon monoxide detectors installed and security cameras installed. Make sure your neighbors have given you permission to leave your property unlocked overnight and that you have enough insurance. Finally, you should never let strangers into your house, even if they say they're moving in next door.