There are many other factors you need to take into consideration before applying for Oregon loans. First, determine your credit quality. Good credit borrowers are often offered the lowest mortgage rates. Lenders may offer rates that are based on poor credit. Bad credit borrowers need to carefully review these rates. The lenders should also be reviewed for the loan structure as well as the payment amount.

Bankrate

If you are looking for mortgage rates in Oregon, you are in luck. Bankrate is one of many places where you can find mortgage rates. Bankrate has relationships to lenders all over the country and will often offer borrowers very low rates.

Sammamish Mortgage

Sammamish Mortgage has a Bellevue location and is a direct lender. They offer conforming and jumbo-rate mortgages, as well as conforming mortgages. They also offer adjustable-rate loans. Sammamish Mortgage rates can be based on credit history, employment history, debt-to-income ratios, and credit. You may also be eligible for a prepayment fee if your mortgage is early repaid.

VA loans

Oregon VA home loans are a great way for veterans and heroes to own a home. These loans can be applied for with flexible criteria and have lower down payments. These loans also have lower interest rates than regular VA loans. Over a 30-year or 15-year mortgage, the interest rate can be reduced by as much as 30%.

Jumbo loans

If you are looking to buy a home in Oregon you might be interested in jumbo loans and mortgage rates. These loans are loans with rates higher than those for conforming loans. This is due both to investor demand and others. To learn more about Oregon's jumbo loans, contact a loan officer.

Piggyback loans

Many homebuyers choose to take out piggyback loans. This mortgage loan allows borrowers to combine two loans into one and pay the same amount each month. To be eligible for a piggyback loan, borrowers need to have a minimum credit score of 680 and a ratio of debt to income of not more than 43%.

FAQ

How much should I save before I buy a home?

It depends on the length of your stay. Start saving now if your goal is to remain there for at least five more years. But if you are planning to move after just two years, then you don't have to worry too much about it.

Is it possible for a house to be sold quickly?

If you have plans to move quickly, it might be possible for your house to be sold quickly. There are some things to remember before you do this. You must first find a buyer to negotiate a contract. The second step is to prepare your house for selling. Third, it is important to market your property. You should also be open to accepting offers.

How can I get rid Termites & Other Pests?

Termites and many other pests can cause serious damage to your home. They can cause serious damage to wood structures like decks or furniture. This can be prevented by having a professional pest controller inspect your home.

How long will it take to sell my house

It all depends upon many factors. These include the condition of the home, whether there are any similar homes on the market, the general demand for homes in the area, and the conditions of the local housing markets. It can take from 7 days up to 90 days depending on these variables.

What is a reverse loan?

A reverse mortgage is a way to borrow money from your home without having to put any equity into the property. This reverse mortgage allows you to take out funds from your home's equity and still live there. There are two types to choose from: government-insured or conventional. With a conventional reverse mortgage, you must repay the amount borrowed plus an origination fee. If you choose FHA insurance, the repayment is covered by the federal government.

What are the key factors to consider when you invest in real estate?

The first thing to do is ensure you have enough money to invest in real estate. You will need to borrow money from a bank if you don’t have enough cash. It is important to avoid getting into debt as you may not be able pay the loan back if you default.

You should also know how much you are allowed to spend each month on investment properties. This amount must be sufficient to cover all expenses, including mortgage payments and insurance.

Finally, you must ensure that the area where you want to buy an investment property is safe. It would be a good idea to live somewhere else while looking for properties.

Statistics

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

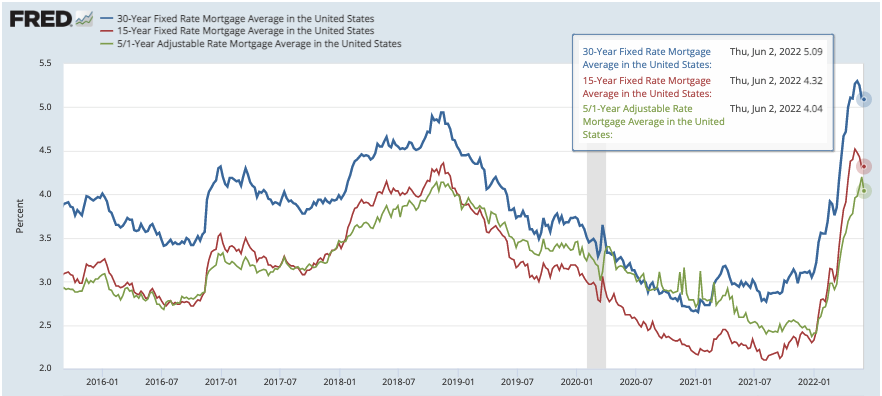

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

External Links

How To

How to Manage a Rent Property

Renting your home can be a great way to make extra money, but there's a lot to think about before you start. We will show you how to manage a rental home, and what you should consider before you rent it.

Here are the basics to help you start thinking about renting out a home.

-

What should I consider first? Take a look at your financial situation before you decide whether you want to rent your house. If you have outstanding debts like credit card bills or mortgage payment, you may find it difficult to pay someone else to stay in your home while that you're gone. Also, you should review your budget to see if there is enough money to pay your monthly expenses (rent and utilities, insurance, etc. This might be a waste of money.

-

How much does it cost for me to rent my house? The cost of renting your home depends on many factors. These factors include location, size, condition, features, season, and so forth. Keep in mind that prices will vary depending upon where you live. So don't expect to find the same price everywhere. Rightmove estimates that the market average for renting a 1-bedroom flat in London costs around PS1,400 per monthly. This means that you could earn about PS2,800 annually if you rent your entire home. It's not bad but if your property is only let out part-time, it could be significantly lower.

-

Is this worth it? You should always take risks when doing something new. But, if it increases your income, why not try it? Be sure to fully understand what you are signing before you sign anything. It's not enough to be able to spend more time with your loved ones. You'll need to manage maintenance costs, repair and clean up the house. You should make sure that you have thoroughly considered all aspects before you sign on!

-

Are there any advantages? You now know the costs of renting out your house and feel confident in its value. Now, think about the benefits. You have many options to rent your house: you can pay off debt, invest in vacations, save for rainy days, or simply relax from the hustle and bustle of your daily life. It's more fun than working every day, regardless of what you choose. If you plan ahead, rent could be your full-time job.

-

How can I find tenants Once you decide that you want to rent out your property, it is important to properly market it. Online listing sites such as Rightmove, Zoopla, and Zoopla are good options. You will need to interview potential tenants once they contact you. This will help you assess their suitability and ensure they're financially stable enough to move into your home.

-

What can I do to make sure my home is protected? If you are worried about your home being empty, it is important to make sure you have adequate protection against fire, theft, and damage. You will need to insure the home through your landlord, or directly with an insurer. Your landlord will likely require you to add them on as additional insured. This is to ensure that your property is covered for any damages you cause. If you are not registered with UK insurers or if your landlord lives abroad, however, this does not apply. In such cases, you will need to register for an international insurance company.

-

You might feel like you can't afford to spend all day looking for tenants, especially if you work outside the home. However, it is important that you advertise your property in the best way possible. Post ads online and create a professional-looking site. Also, you will need to complete an application form and provide references. Some prefer to do it all themselves. Others hire agents to help with the paperwork. You'll need to be ready to answer questions during interviews.

-

What happens once I find my tenant If you have a current lease in place you'll need inform your tenant about changes, such moving dates. You may also negotiate terms such as length of stay and deposit. While you might get paid when the tenancy is over, utilities are still a cost that must be paid.

-

How do I collect the rent? When the time comes to collect the rent, you'll need to check whether your tenant has paid up. You'll need remind them about their obligations if they have not. Before you send them a final invoice, you can deduct any outstanding rent payments. If you're having difficulty getting hold of your tenant you can always call police. They won't normally evict someone unless there's been a breach of contract, but they can issue a warrant if necessary.

-

How can I avoid potential problems? Renting out your house can make you a lot of money, but it's also important to stay safe. Consider installing security cameras and smoke alarms. Check with your neighbors to make sure that you are allowed to leave your property open at night. Also ensure that you have sufficient insurance. Do not let strangers in your home, even though they may be moving in next to you.